Rising compliance costs, changing customer expectations, and competition from FinTech's, call for better digital documentation methods. The advent of social media, mobile devices, and other new technologies, brought profound changes to customer expectations. As regulations change faster than ever, financial advisory, banks, and wealth management firms need to prepare for regulatory changes before they occur.

To navigate through these changes, global banks, and financial service firms are investing in document automation technology. It improves their internal efficiency, reduces operational costs, and helps in offering better customer experiences.

Financial document automation software is designed to efficiently automate the assembly of financial documents, simplifying and streamlining the entire document generation process. By utilizing up-to-date templates that adhere strictly to brand guidelines, financial document automation ensures that all generated documents meet compliance standards without the need for tedious checks.

Unlike legacy systems that require coding changes for template updates and often limit document types, it offers a comprehensive approach, supporting a wide range of document types in one unified system. Business users can easily utilize existing templates or modify them independently without requiring IT support.

Customizing financial documents for each customer can be time-consuming and prone to errors. This is particularly challenging when clients require consolidated investment reports or precise real-time reports. Document automation software allows you to produce them accurately and without errors. You can easily generate documents for thousands of clients or produce several documents for an individual client without any hassle.

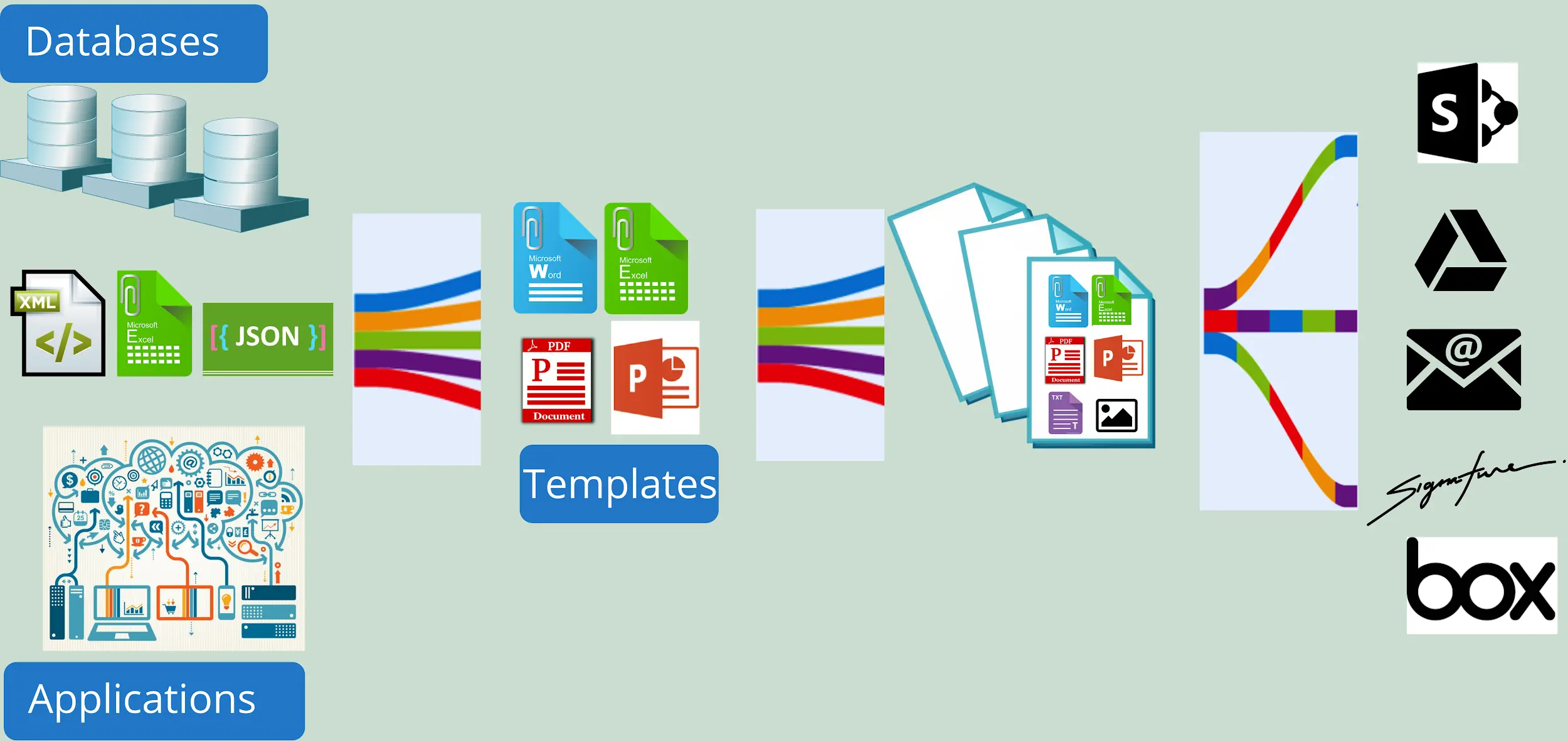

It pulls information about customers, transaction details, and other stored data into Word/PDF/Excel templates to generate individualized documents. The result is a highly accurate document tailored to a given customer in a fraction of the time.

As financial operations become increasingly complex, error-free financial documents become even more critical to ensuring smooth business operations.

Below table lists the key financial documents commonly automated in modern organizations:

|

Document Type |

What they Do |

Where they're used |

|

Core Business Documents |

||

|

Financial Statements |

Formal records of financial activities such as balance sheets, income statements, and cash flow statements. |

|

|

Purchase Orders |

Official documents from buyers to sellers specifying agreed-upon products/services, quantities, and prices. |

|

|

Bank Statements |

Summaries of financial transactions within a specific period, including deposits, withdrawals, and balances. |

|

|

Compliance and Regulatory Documents |

||

|

Audit Reports |

Detailed financial records, procedures, and controls audits, including findings and recommendations. |

|

|

Expense Reports |

Records of business-related expenses incurred by employees, including receipts and reimbursement requests. |

|

|

Credit Notes |

Documents issued to correct errors or adjust charges on previous invoices. |

|

|

Financial Proposals |

Documents outlining financial terms for potential business agreements or services. |

|

|

Payroll Documents |

Employee compensation records, including paystubs, tax forms, and benefits statements. |

|

|

Budget Reports |

Documents tracking actual spending against budgets, including variances and forecasts. |

|

Financial document automation can solve many issues that pull your company’s bottom line down. Among them are freeing time from tedious manual processes like document retrieval during an audit, simplifying complex procedures between broker-dealers and RIAs, and managing high volume-high priority work effortlessly that requires an effortless linkage between clients, advisors, in-house teams, and auditors.

Besides, focusing on document automation software means you can concentrate on what’s important and let your team work on a system that aligns with your crucial document generation requirements like pensions, IRAs, annuities, and mortgages.

The system offers comprehensive control over template management. Only authorized users have the ability to upload or delete templates, while the rest of the team utilizes these templates for document creation. This ensures that your team is always working with the most up-to-date templates.

The benefits of financial document automation extend beyond efficiency gains and document creation, offering significant operational, compliance, security, and business advantages.

Operational Benefits

Operational benefits form the basis of financial document automation, enhancing efficiency, accuracy, and resource optimization to improve our core processes.

|

Benefit |

What It Does |

|

Reduced Processing Time |

Automates routine tasks, standardizes workflows, scales operations, and optimizes resources. |

|

Improved Accuracy |

Eliminates manual errors, ensures validation, audits formulas, and applies uniform formats. |

|

Enhanced Productivity |

Automates workflows, accelerates productivity, boosts job satisfaction, and monitors performance. |

|

Lower Costs |

Reduces labor, error handling, and storage costs while streamlining processes. |

|

Operational Risk Reduction |

Standardizes workflows, secures document handling, ensures disaster recovery, and sends real-time alerts. |

|

Performance Optimization |

Tracks analytics, measures effectiveness, ensures continuous improvement, and optimizes resource utilization. |

Compliance and Security Benefits

Ensuring compliance and security protects sensitive data, promotes accountability, and minimizes risks while adhering to regulatory standards.

|

Benefit |

What It Does |

|

Automated Compliance Checks |

Ensures regulatory adherence by automating compliance checks and real-time updates. Prepares audit-ready documents consistently. |

|

Enhanced Data Security |

Implements end-to-end encryption, role-based access controls, and data masking to secure sensitive information. |

|

Complete Audit Trails |

Maintains detailed logs for accountability, compliance reporting, and traceability of all document changes. |

|

Reduced Compliance Risks |

Mitigates risks with policy enforcement and comprehensive audit trails to avoid non-compliance penalties. |

Business Impact

The business impact benefits drive strategic decision-making by enhancing overall customer satisfaction and gaining a competitive edge.

|

Benefit |

What It Does |

|

Better Cash Flow Management |

Provides real-time data access, trend analysis, and comprehensive reporting to support strategic insights and planning. |

|

Improved Customer Service |

Speeds up document processing ensures accuracy, and enhances transparency for better customer interactions. |

|

Enhanced Decision Making |

Offers real-time data, reliable analytics, and comprehensive reporting to support informed decisions. |

|

Competitive Advantage |

Delivers operational excellence, innovation leadership, and scalable market responsiveness and growth solutions. |

From optimizing workflows and enhancing security to driving business growth, these benefits highlight the significance of automation.

For example, Financial document automation in Link can elevate the entire loan experience. It can reduce costs, restrict fraud, and better the loan process, which gets the business to expand with the same number of people towards a larger audience.

And it’s not just the generation and delivery of loan payment notices but, in general, other financial documents that can be automated like personal financial statements, creation of financial reports, and review reports.

Consider the case of commercial lending. While the phrasing in it needs to be intact for all documents every time, the customer’s details, loan amount, and percentages vary for each individual. Unless there is document automation here, you risk leaving your team with inaccurate records, poor customer service, and most importantly, bleeding your business over leaking gaps in your process.

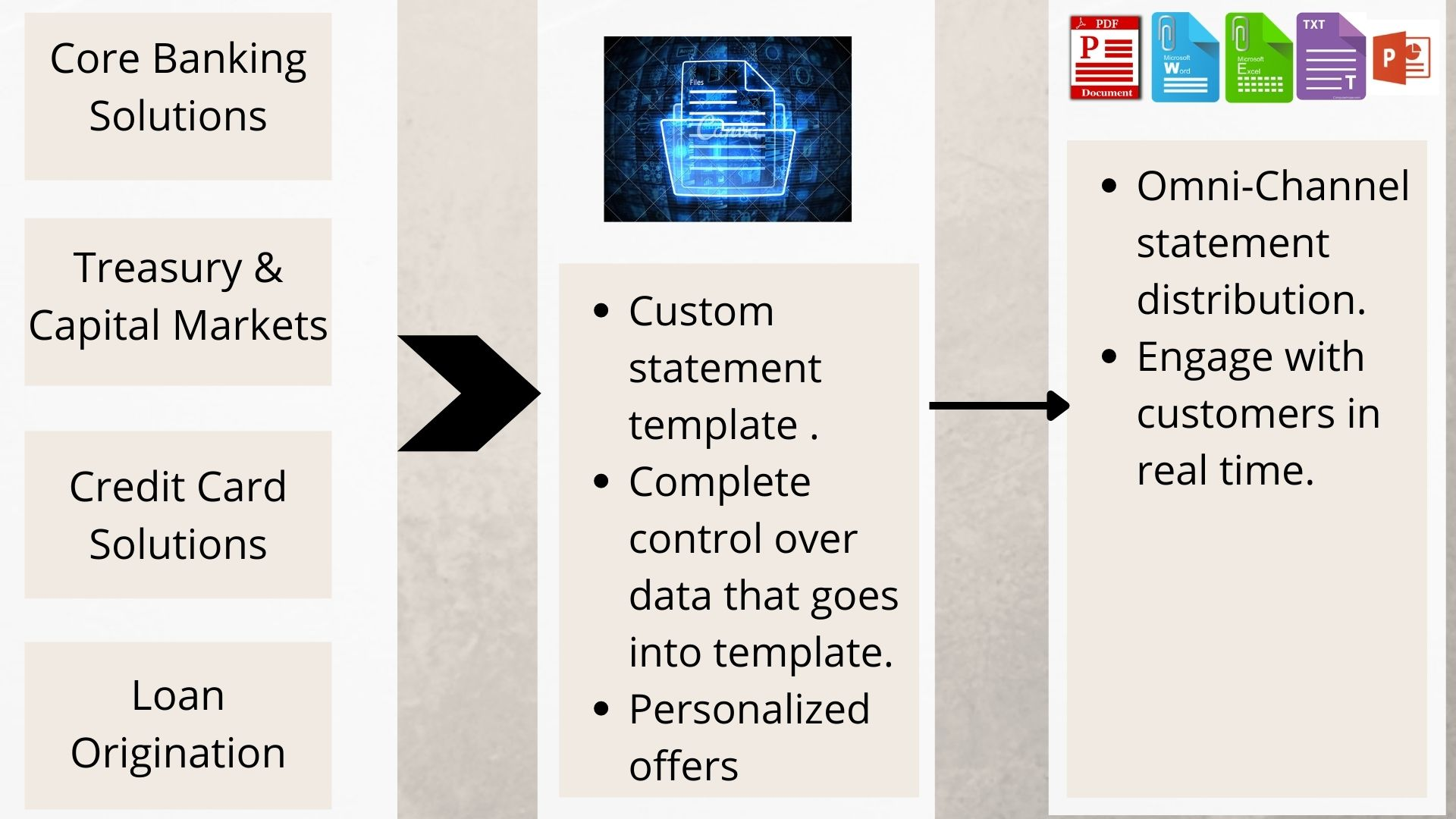

On-demand (real-time) download of statements in the device of customer's choice improves customer experience and empowerment. Using enterprise document automation, customers can download a single consolidated statement from a variety of business systems including loan origination and core banking. The speed and size of downloadable PDFs are important. The system should be scalable to address the generation of millions of documents per month and able to download real-time statements in sub-seconds for it to download on a mobile device.

Finance companies carry out investments and partnerships with companies in different countries and regions. Thus the documents need to be generated in different languages. Maintaining different templates for each language is difficult. Thus the system should be able to generate multiple document types from a single master template.

Documents are always generated using the most up-to-date templates and brand guidelines. Since these are system generated, they 100% adhere to standards, thus saving the need to check and double-check documents for compliance issues.

In most of the legacy systems, document creation works by coding templates in the system. However, every time there is a change in the templates, the code will have to be changed. Moreover, they only generate a few document types. You need enterprise document generation software, a single system that addresses every document type and generation need.

Business user-friendly: Business users should be able to use existing templates as-is. They also should be able to change the templates by themselves without IT intervention.

Generation Modes: The system should support all three modes of document generation - bulk, on-demand (real-time), and interactive.

Integration with third-party data sources: It should provide APIs and Webhooks to facilitate seamless integration with the current IT ecosystem. Thus, the users can generate from various data sources like core banking, portfolio partnership, and accounting platforms to pull in data and assemble them into a document template.

Workflow Integration: With workflow integration, your team is equipped to assemble and share contracts and agreements spread across different solutions quickly and accurately without worrying about data loss or threats to information security.

Variety of formats: Cater to the generation of various document formats for different distribution channels. It should be able to generate a TXT file for sending through SMS or a password-protected PDF for download.

EDocGen offers the best customer communication and digital experience platform that enables new account creation, account servicing, and personalized correspondence at scale.

It's a DIY business user-friendly document automation solution. The best part is business users can use existing custom templates for document generation. Moreover, it's flexible for automating the entire organization's documents.

Financial services often need to reach a wider audience while keeping the workforce the same yet improving profitability. With better speed and accuracy, financial document automation can deliver just that. Accelerate your organization's digital transformation journey with EDocGen document automation software.

One of its standout features is the ability to generate both PDF forms and PDF documents seamlessly, catering to a variety of business needs while ensuring user-friendliness.

This article has explored how financial document automation can address organizations' challenges in managing financial processes.

Here’s a brief takeaway on what automation can help you achieve:

In the realm of financial services, when compliance, customer data security, and the risk of potential breaches become significant concerns, it’s time to consider automating processes. This can reduce the strain on your resources and drastically cut down the time you currently invest in these tasks.

Additionally, maintaining uniformity in your team's internal and external communications is a key factor in enhancing work quality. This approach boosts productivity without compromising standards. It also protects your clients from potential challenges, all while providing an exceptional and tailored customer experience consistently. Financial document automation elevates your performance, allowing you to surpass competitors even when operating with limited resources.

Financial document automation improves compliance by:

Sensitive financial data is safeguarded through:

Yes, it integrates in the following ways:

The templates provide extensive customization, including:

Different currencies and formats are handled by: