Introduction

Imagine spending one-fifth of your workweek just looking for documents — that’s the reality for many employees today.

Gartner also reports that 70% to 80% of all business information is unstructured, making companies deal with inefficiencies, errors, and lost opportunities.

The good part? Companies using automated systems see a significant drop in processing times and error rates and a marginal increase in revenue year over year.

It's obvious! Efficient document management isn’t just about saving time; it’s about ensuring that your business's hard work all year isn’t lost to disorganization or oversight.

Hence, we’ve structured this guide to help you understand the documents your business needs, their purposes, and best practices for managing them so that you leave with more clarity and confidence to organize what matters most.

Here’s what you can expect:

-

The 12 essential document types,

-

Their purpose and best practices

-

The common challenges (and actionable solutions!)

-

A step-by-step guide to keep your workflow efficient and organized

Crucial Documents for Your Business

In this section, we’ll discuss the key types of business documents, from strategic planning to internal communication.

Read on to understand how they help automate operations and support your organization’s growth.

1. Strategic Planning Documents

What They Are: High-level documents that outline your organizational goals and translate vision into actionable plans to guide team decision-making.

Why They Matter: They align teams with long and short-term goals, clarify roles, help measure progress, attract investors, and adapt to market changes.

Types of Strategic Planning Documents:

i) Business Plans

A business plan is your organization’s strategic roadmap, outlining how to achieve goals and manage resources over 3–5 years. It includes market analysis, financial projections, and operational strategies and evolves with market needs.

Source: Amazon Strategy Consulting Services

|

Purpose

|

-

Guides strategic decision-making across departments.

-

Attracts investors by demonstrating viability.

-

Aligns departmental goals with organizational objectives.

-

Measures progress and adjusts strategies effectively.

|

|

Teams Involved

|

-

Executive Leadership sets the direction and goals.

-

Finance develops budgets and allocates resources.

-

Operations align processes with objectives.

-

Marketing creates campaigns.

-

Sales targets markets and crafts strategies.

|

|

Best Practices

|

-

Conduct thorough market research.

-

Include financial projections backed by data.

-

Review quarterly to adapt to changes.

-

Store securely with version control.

-

Break into short- and long-term goals.

-

Create executive summaries for stakeholders.

|

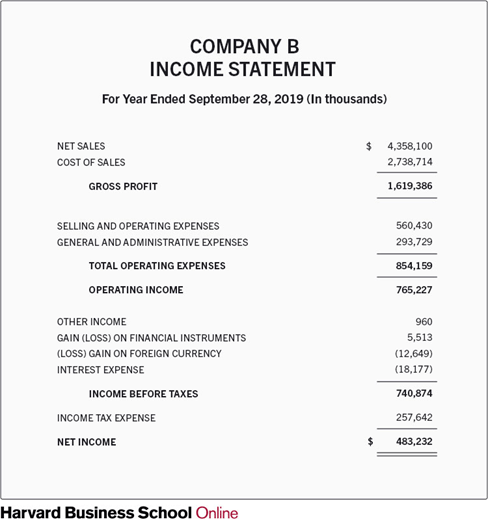

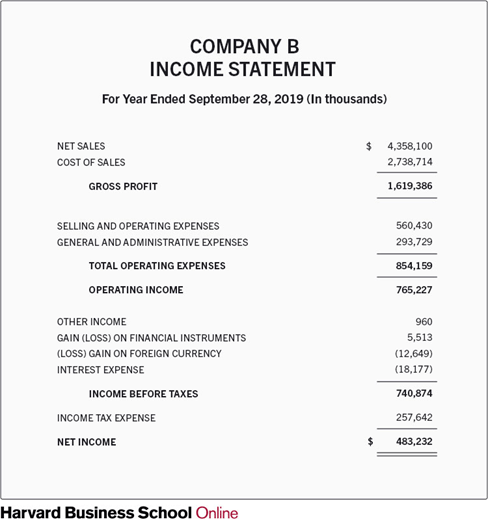

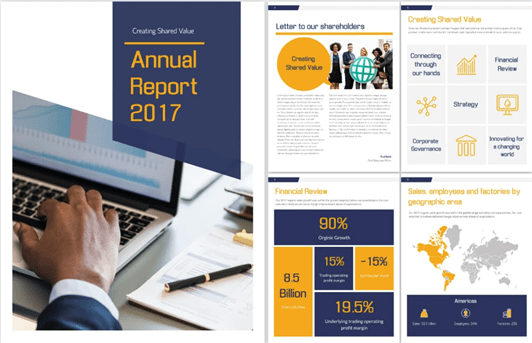

ii) Financial Statements

|

Purpose

|

-

Helps leaders make better decisions with accurate financial data.

-

Gives stakeholders a clear view of the organization’s finances.

-

Shows financial stability to secure funding.

-

Makes sure the organization meets tax rules and other regulations.

-

Compares performance over time and with industry benchmarks.

|

|

Teams Involved

|

-

Accounting keeps and updates financial records.

-

Finance looks for trends and suggests improvements.

-

Executive Leadership uses these records for planning decisions.

-

Compliance makes sure all rules and standards are followed.

-

External Auditors check for accuracy and compliance.

-

Board of Directors reviews the organization’s finances and governance.

|

|

Best Practices

|

-

Conduct thorough market research.

-

Include financial projections backed by data.

-

Review quarterly to adapt to changes.

-

Store securely with version control.

-

Break into short- and long-term goals.

-

Create executive summaries for stakeholders.

|

2. Legal and Compliance Documents

What They Are: Documents that define operational boundaries, protect organizational interests, and ensure compliance with industry regulations.

Why They Matter: They help mitigate risks, prevent disputes, speed up resolutions, and protect you during audits or legal challenges.

Types of Legal and Compliance Documents:

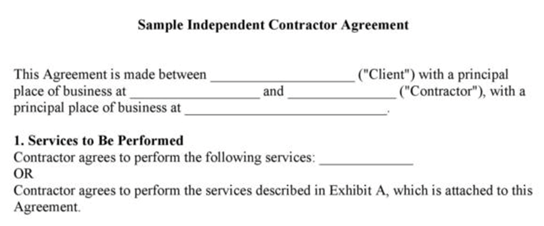

i) Contracts and Agreements

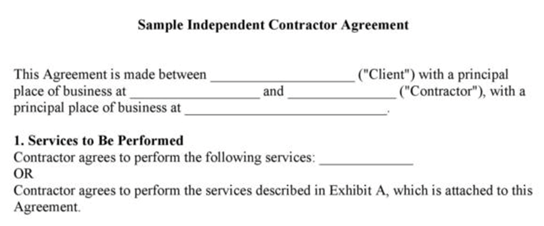

Contracts and agreements are legally binding documents that define the rights, responsibilities, and obligations between organizations and their stakeholders, such as employees, vendors, customers, and partners.

This snippet shows a sample contract template, highlighting key elements. For illustrative purposes only.

|

Purpose

|

-

Set clear terms and conditions for business relationships.

-

Protect the organization by defining rights, responsibilities, and remedies.

-

Lower business risks by clearly documenting expectations.

-

Create accountability for managing and enforcing agreements.

-

Provide a reference for solving disputes and managing relationships.

|

|

Teams Involved

|

-

Legal Team reviews and approves contract language to ensure protection.

-

Procurement Team uses contracts to manage vendor relationships.

-

Sales Team formalizes customer relationships and agreements.

-

Human Resources manages employment contracts and related agreements.

-

Finance tracks financial obligations and payments in contracts.

-

Operations oversee the implementation and monitoring of contract requirements.

|

|

Best Practices

|

-

Use templates for common contract types to ensure consistency.

-

Set up a clear review and approval process with assigned roles.

-

Keep contracts in a secure, centralized repository with version control.

-

Use automated reminders for renewals and key deadlines.

-

Document negotiation history and changes to avoid confusion.

-

Have clear steps for making updates or changes to contracts.

-

Audit contracts regularly to ensure compliance and performance.

-

Use electronic signatures to speed up the process.

|

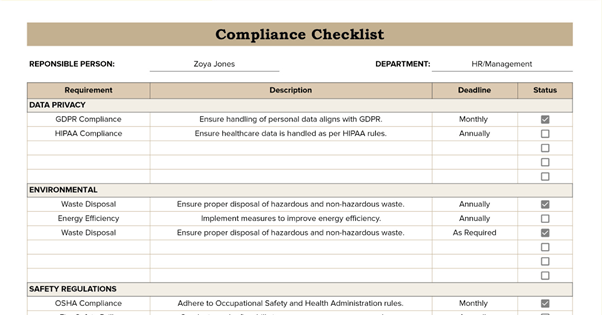

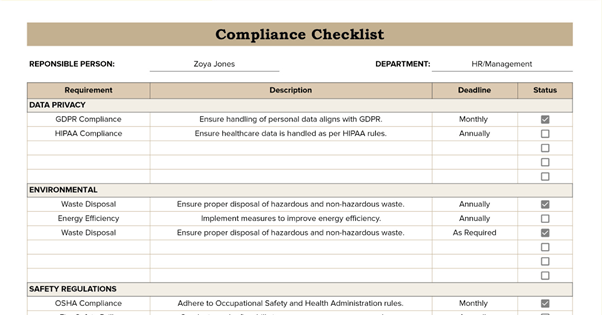

ii) Compliance Documents

Compliance documents show an organization’s adherence to industry regulations, government requirements, and internal policies.

They include regulatory filings, audit reports, certifications, and policy statements, helping businesses avoid penalties and maintain operating licenses.

|

Purpose

|

-

Shows that the organization meets regulatory and industry standards.

-

Provides evidence of due diligence during audits and reviews.

-

Establishes clear guidelines for employee behavior and organizational processes.

-

Helps identify and address compliance issues proactively.

-

Protects the organization by documenting compliance efforts and risk management.

|

|

Teams Involved

|

-

Compliance Team manages and maintains compliance documentation.

-

Legal Team ensures documents meet current regulatory requirements.

-

Risk Management identifies and resolves potential compliance issues.

-

Executive Leadership sets compliance policies and oversees implementation.

-

Department Heads ensure documentation reflects actual practices.

-

Internal Audit Team reviews compliance during regular audits.

|

|

Best Practices

|

-

Create detailed compliance manuals with clear policies and procedures.

-

Schedule regular reviews to keep the documentation current.

-

Use a tracking system for compliance deadlines and requirements.

-

Keep detailed records of training and awareness programs.

-

Document all compliance incidents and their resolutions.

-

Set clear steps for updating compliance documentation.

-

Store documents securely with controlled access.

-

Regularly test compliance procedures for accuracy and effectiveness.

|

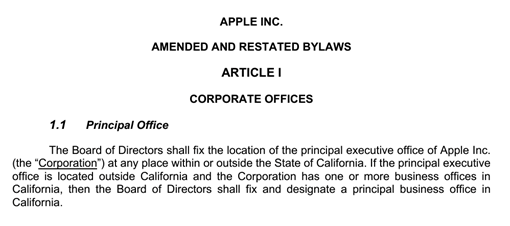

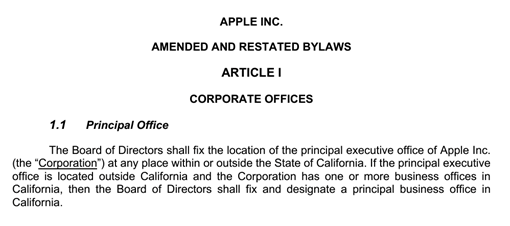

iii) Corporate Bylaws

Corporate bylaws are foundational documents that define an organization’s governance structure and operational framework.

|

Purpose

|

-

Sets the fundamental rules for organizational governance.

-

Defines roles, responsibilities, and authority levels.

-

Provides clear processes for decision-making and conflict resolution.

-

Creates a framework for managing organizational changes.

-

Ensures compliance with corporate governance laws.

|

|

Teams Involved

|

-

Board of Directors uses bylaws as a guide for governance decisions.

-

Executive Leadership ensures operations align with bylaw requirements.

-

Legal Team maintains and interprets bylaw provisions.

-

Corporate Secretary manages documentation and amendments.

-

Shareholders refer to bylaws to understand their rights and responsibilities.

-

Compliance Team ensures bylaws meet regulatory standards.

|

|

Best Practices

|

-

Review bylaws annually to keep them relevant and effective.

-

Maintain detailed records of amendments and their justifications.

-

Create clear procedures for proposing and implementing changes.

-

Ensure bylaws are accessible but secure.

-

Develop supplementary documents to explain complex provisions.

-

Provide regular training for key stakeholders on bylaw requirements.

-

Document interpretation precedents to ensure consistency.

-

Establish clear steps for governance during emergencies.

|

3. Financial Documents

What They Are: Records that track, manage, and report monetary transactions, meeting legal and tax requirements.

Why They Matter: They provide transparency, support financial planning and relevant decision-making, and provide necessary help during audits.

Types of Financial Documents:

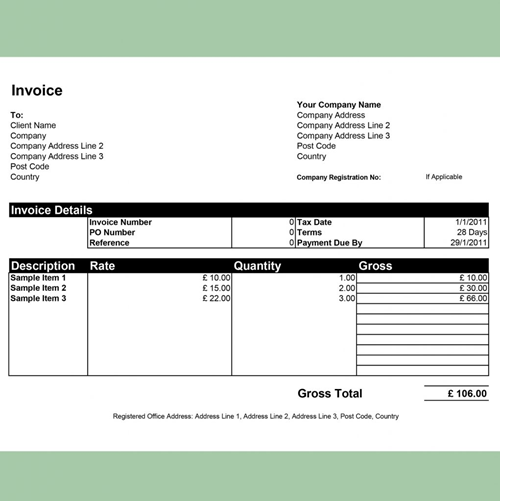

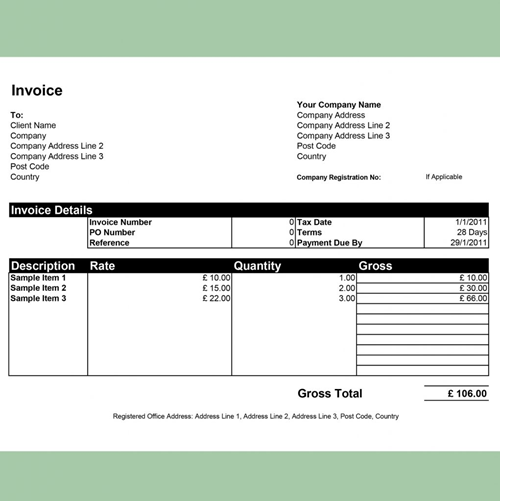

i) Invoices

Invoices are formal requests for payment that document transactions between organizations and their customers. They ensure accurate records, maintain cash flow, and help build professional client relationships.

|

Purpose

|

-

Records financial transactions and requests payment formally.

-

Provides an audit trail for tax compliance and accounting.

-

Helps track accounts receivable and manage cash flow.

-

Serves as legal documentation for disputes and collections.

-

Analyzes sales patterns and customer payment behaviors.

-

Supports financial forecasting and budgeting.

|

|

Teams Involved

|

-

Accounting Team generates and tracks invoices and payments.

-

Finance uses invoice data for planning and reporting.

-

Sales Team reviews invoices for commission calculations and customer history.

-

Customer Service resolves invoice-related queries and disputes.

-

Legal Team uses invoices for collections and documentation.

-

Management evaluates invoice data to assess performance.

|

|

Best Practices

|

-

Conduct thorough market research.

-

Include financial projections backed by data.

-

Review quarterly to adapt to changes.

-

Store securely with version control.

-

Break into short- and long-term goals.

-

Create executive summaries for stakeholders.

|

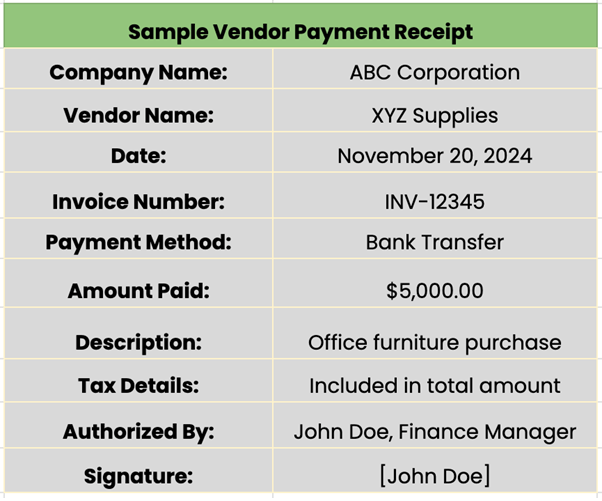

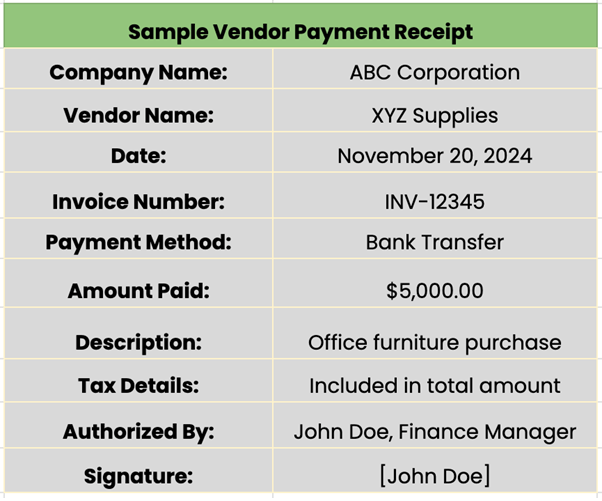

ii) Receipts and Expense Documentation

Receipts and expense documents provide evidence of financial transactions and support expense management and internal controls.

|

Purpose

|

-

Provides proof of payment for goods and services.

-

Supports tax deduction claims and ensures compliance with regulations.

-

Tracks and controls organizational expenses accurately.

-

Creates accountability for expense reporting and reimbursements.

-

Facilitates budget monitoring and cost control.

-

Serves as evidence for internal and external audits.

|

|

Teams Involved

|

-

Accounting Team processes and archives receipts for financial records.

-

Finance uses receipt data for budgeting and expense analysis.

-

Employees submit receipts for reimbursement and project tracking.

-

Management reviews expense documentation for budget compliance.

-

Audit Team verifies receipts during audits.

-

Tax Team uses receipts for preparing tax returns.

|

|

Best Practices

|

-

Use digital systems to capture and store receipts.

-

Establish clear policies for submission and reimbursement.

-

Organize receipts systematically for easy access.

-

Review expense patterns regularly to ensure budget compliance.

-

Maintain backup copies of critical receipts.

-

Implement workflows for expense approval.

-

Set procedures for handling missing or damaged receipts.

-

Conduct regular audits of expense documentation.

|

4. Internal Communication Documents

What They Are: Documents that help with consistent information sharing and knowledge management within the organization.

Why They Matter: They keep communication clear, improve efficiency, reduce confusion, and make training more effective.

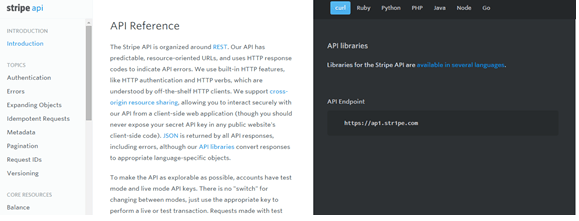

i) Product Guides

|

Purpose

|

-

Serves as a centralized source of accurate product information.

-

Ensures consistent product knowledge across departments.

-

Supports efficient training for new team members.

-

Enables quick resolution of customer inquiries with standardized information.

-

Facilitates product updates and version control.

-

Provides accurate documentation for marketing and sales teams.

|

|

Teams Involved

|

-

Product Development creates and maintains technical information.

-

Marketing ensures alignment with product messaging and branding.

-

Sales Team uses guides to represent products accurately.

-

Customer Service relies on guides to resolve product-related inquiries.

-

Training Teams incorporate guides into onboarding materials.

-

Quality Assurance verifies accuracy in product documentation.

|

|

Best Practices

|

-

Use structured templates for consistent presentation.

-

Regularly review guides to ensure accuracy.

-

Create clear processes for updating product information.

-

Maintain version control for product iterations.

-

Include visual aids and examples to enhance understanding.

-

Ensure guides are accessible to all user groups.

-

Collect feedback regularly to improve content.

-

Create searchable digital formats for easy reference.

|

What They Are:Documents that outline workplace policies, roles, and responsibilities and provide training materials to help employees perform effectively.

Why They Matter:They ensure employees understand expectations, maintain compliance, and support skill development for better job performance.

Types of Employee Documents:

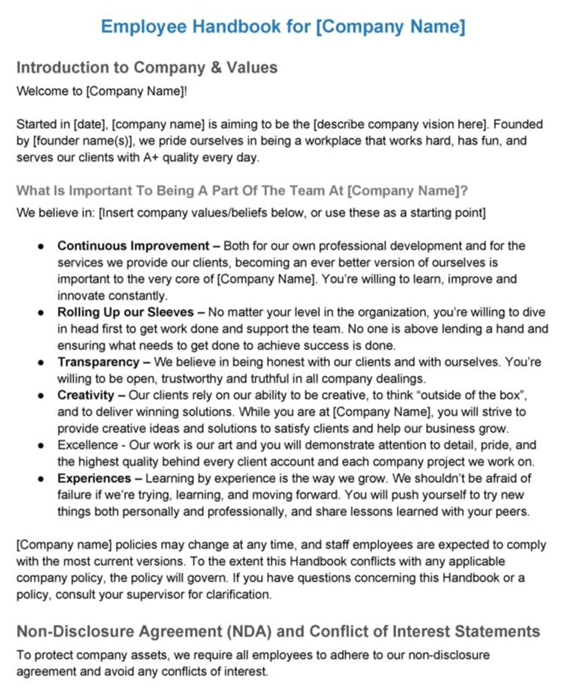

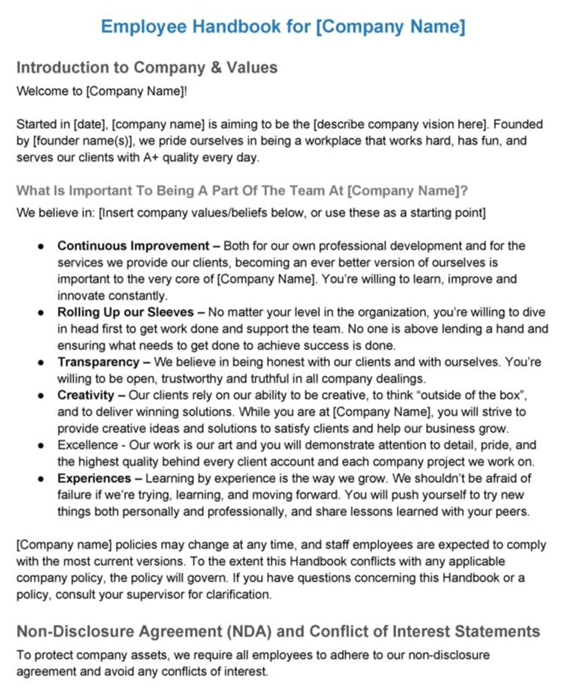

i) Employee Handbooks

Employee handbooks are comprehensive guides that outline workplace policies, procedures, and organizational values.

|

Purpose

|

-

Outlines workplace policies and procedures clearly.

-

Communicates employee rights and organizational expectations.

-

Promotes consistency in applying workplace standards.

-

Helps employees align with the company’s values and goals.

|

|

Teams Involved

|

-

Human Resources creates and updates handbook content.

-

Legal Team ensures compliance with labor laws and regulations.

-

Management enforces the policies outlined in the handbook.

|

|

Best Practices

|

-

Regularly update handbooks to reflect policy and legal changes.

-

Use simple, inclusive language for clarity.

-

Include sections on company values, benefits, and employee rights.

-

Distribute handbooks digitally and ensure accessibility.

-

Provide training on key sections during onboarding.

|

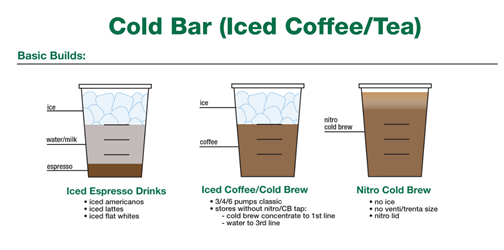

ii) Training Modules

Training manuals are structured resources designed to teach employees the skills and knowledge needed for their roles.

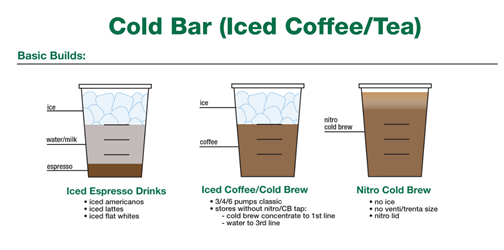

A sample training module showcasing recipes and procedures used in Starbucks' barista training.

|

Purpose

|

-

Provides employees with structured guidance for their roles.

-

Standardizes training processes across teams and departments.

-

Supports professional development and improves onboarding efficiency.

|

|

Teams Involved

|

-

Training and Development designs and updates manuals.

-

Department Leads contribute role-specific content.

-

Human Resources manages distribution and tracks participation.

|

|

Best Practices

|

-

Use interactive and engaging formats to boost learning retention.

-

Regularly review and update manuals to keep content relevant.

-

Organize content logically for easier understanding.

-

Ensure accessibility across devices and locations.

-

Track completion rates and assess learning outcomes.

|

6. Business Development Documents

What They Are: Documents that present your organization’s value proposition, track opportunities, and manage relationships with clients and partners.

Why They Matter: They provide a structured approach to your growth plans by helping build trust, secure opportunities, and support new and old client relationships.

Types of Business Development Documents:

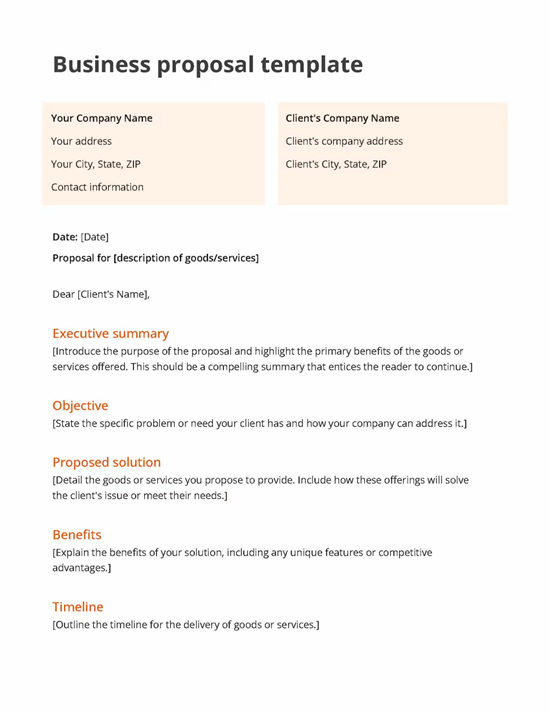

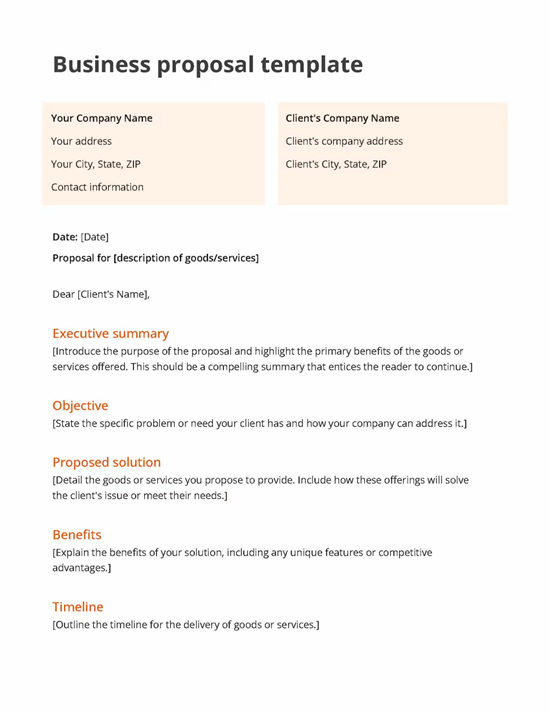

i) Proposals

Business proposals are persuasive documents that outline solutions to client needs and opportunities.

They showcase organizational expertise and capabilities, aiming to win new business through clear, tailored strategies.

|

Purpose

|

-

Presents comprehensive solutions to address specific client challenges.

-

Showcases organizational expertise and competitive advantages.

-

Defines project scope, deliverables, and financial expectations.

-

Lays the groundwork for contract negotiations and project planning.

-

Helps track and manage business development opportunities.

-

Ensures consistent messaging across various opportunities.

|

|

Teams Involved

|

-

Business Development leads proposal strategy and client communication.

-

Subject Matter Experts contribute technical content and solutions.

-

Finance develops pricing strategies and cost analyses.

-

Legal reviews terms to minimize risks.

-

Marketing ensures alignment with brand messaging.

-

Project Management outlines implementation plans and timelines.

-

Executive Leadership reviews and approves bigger proposals.

|

|

Best Practices

|

-

Use customizable templates for various opportunities.

-

Set up transparent workflows for proposal review and approval.

-

Conduct win/loss analysis to drive continuous improvement.

-

Keep detailed records of versions and client feedback.

-

Develop standardized but flexible pricing models.

-

Regularly review proposals to ensure effectiveness.

-

Establish clear guidelines for customization.

-

Implement quality control measures to ensure accuracy.

|

ii) Sales Presentations

Sales presentations are dynamic documents highlighting value propositions and solutions for potential clients.

They combine visuals, data, and storytelling to engage audiences and support decision-making.

|

Purpose

|

-

Showcases organizational capabilities and solutions in an engaging way.

-

Supports in-person and virtual sales meetings with professional aids.

-

Demonstrates understanding of client challenges and proposed solutions.

-

Maintains consistent messaging across sales opportunities.

-

Serves as reference material for follow-up discussions.

|

|

Teams Involved

|

-

Sales Team identifies client needs and shapes presentation strategies.

-

Marketing ensures alignment with brand messaging and visuals.

-

Design Team creates layouts and visual elements.

-

Product Team provides technical content and solution details.

-

Legal reviews content for compliance and accuracy.

-

Customer Success contributes case studies and success stories.

|

|

Best Practices

|

-

Create modular presentation templates for easy customization.

-

Define clear guidelines for presentation structure and flow.

-

Regularly update statistics and case studies for relevance.

-

Maintain consistent branding in all presentations.

-

Establish a review process for accuracy and polish.

-

Develop contingency plans for technical issues during delivery.

-

Provide regular training on effective presentation delivery.

-

Collect feedback to improve presentation effectiveness.

|

7. Analysis and Reporting Documents

What They Are: Reports that turn organizational data into actionable insights for better decision-making.

Why They Matter: They help stakeholders track performance, identify opportunities, and support continuous improvement.

Types of Analysis and Reporting Documents:

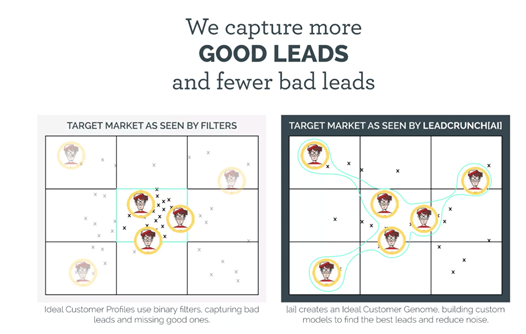

i) Business Reports

Business reports provide structured analyses of organizational performance, market trends, and strategic initiatives. They combine data with actionable insights, supporting decision-making and accountability across the organization.

A visual example of a standard business report.

|

Purpose

|

-

Analyzes business performance and key metrics systematically.

-

Supports informed, data-driven decisions at all levels.

-

Ensures accountability through regular performance tracking.

-

Identifies trends and opportunities for improvement.

-

Maintains a historical record of decisions and performance.

-

Supports communication across organizational levels.

|

|

Teams Involved

|

-

Business Analysis leads report creation and data analysis.

-

Department Managers offer context and performance insights.

-

Finance validates financial data and ensures accuracy.

-

IT Team supports data collection and reporting systems.

-

Executive Leadership uses reports for strategic planning.

-

Operations provide operational data and context.

|

|

Best Practices

|

-

Define clear reporting schedules and deadlines.

-

Use standardized templates for consistency across reports.

-

Validate data to ensure accuracy and reliability.

-

Include executive summaries highlighting key findings.

-

Maintain consistent metrics and calculation methods.

-

Regularly review reports for effectiveness and relevance.

-

Document reporting procedures clearly for transparency.

-

Use version control to manage report updates and distributions.

|

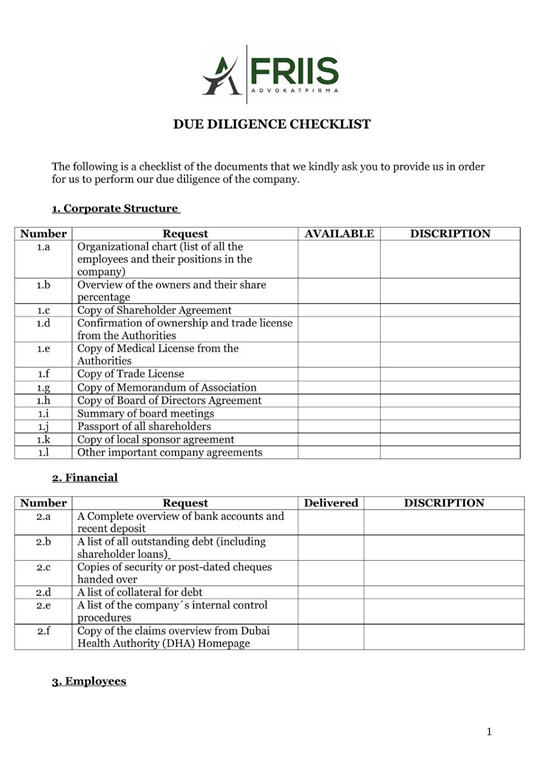

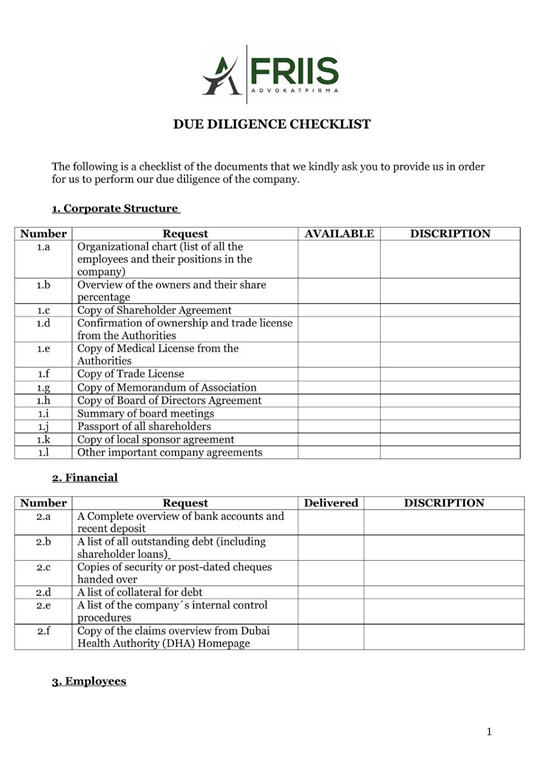

ii) Due Diligence Reports

Due diligence reports provide in-depth analyses of business opportunities, risks, and potential partnerships.

|

Purpose

|

-

Investigates business opportunities and risks comprehensively.

-

Supports strategic decisions in significant business initiatives.

-

Ensures accountability in evaluation and decision-making processes.

-

Provides legal protection through detailed analysis and documentation.

-

Assesses potential partnerships and investments effectively.

-

Maintains records of evaluation criteria and decisions for future reference.

|

|

Teams Involved

|

-

Legal Team oversees compliance and regulatory reviews.

-

Finance conducts financial analysis and verification.

-

Operation evaluates operational capabilities and associated risks.

-

IT Team reviews technical infrastructure and capabilities.

-

Human Resources assesses employment and cultural factors.

-

Executive Leadership makes final decisions based on findings.

|

|

Best Practices

|

-

Use comprehensive checklists to cover all review areas.

-

Define clear standards for documenting findings.

-

Secure sensitive information using data rooms.

-

Maintain detailed records of all information sources.

-

Set escalation procedures for addressing critical findings.

-

Provide regular updates on progress and preliminary results.

-

Establish strict confidentiality protocols throughout the process.

-

Use structured formats for final reports to ensure clarity and consistency.

|

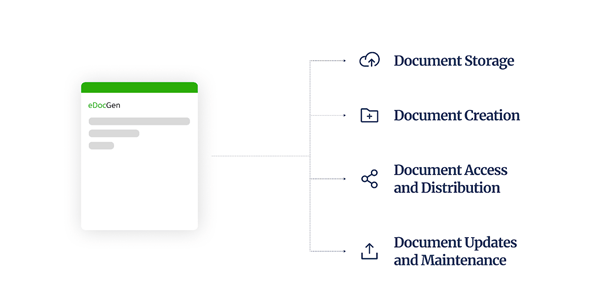

The Complete Process for Document Management

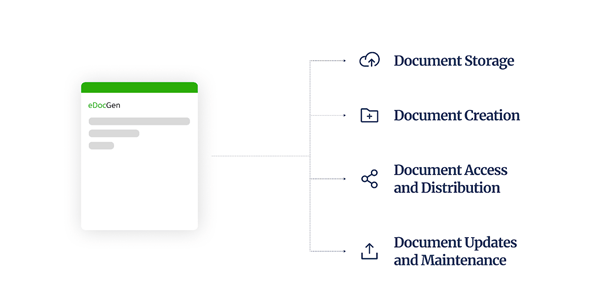

Now that you’ve learned the different types of documents, it’s important to know how to execute them. Keep reading to understand how this 4-step guide helps you manage your workflow seamlessly, from creation to updates.

Step 1: Document Creation

Every great system starts with a solid foundation. Document creation sets the tone for consistency, quality, and efficiency.

-

Why it Matters: Standardized templates and style guides ensure all documents align with organizational standards. Clear naming conventions simplify organization, while automated systems make the process faster and error-free.

-

How to Excel: Use quality control checklists to review content, maintain a central repository for templates, and implement version tracking from day one.

Step 2: Document Storage

Once created, documents must be stored securely while remaining easily accessible.

-

Key Practices: Organize files in logical hierarchies for quick navigation. Protect sensitive information with encryption and controlled access. Regular backups (both onsite and offsite) are crucial to prevent data loss.

-

Optimize: Automated archiving systems keep storage streamlined, while search functionalities help you retrieve files quickly and efficiently.

Step 3: Document Access and Distribution

Making documents available to the right people—without compromising security—is critical.

-

Access Rules: Assign role-based permissions to control who sees what. Use secure file-sharing systems and establish workflows for approvals.

-

Stay Transparent: Maintain version control and audit trails to track document usage. Regularly review and update access permissions to ensure ongoing security.

Step 4: Document Updates and Maintenance

Documents aren’t static—they evolve over time. Regular updates ensure they stay relevant, accurate, and compliant.

-

The Process: Schedule reviews based on document type, systematically archive outdated versions, and maintain clear change logs.

-

Compliance First: Conduct regular checks to meet legal standards and streamline procedures for retiring old documents.

Common Document Management Challenges and Their Solutions

Managing documents effectively requires overcoming several challenges that may come up in version control, access, storage, compliance, and security.

Below, we break down each challenge's root causes and actionable solutions.

1. Version Control Challenges

Keeping track of multiple versions of the same document is a persistent issue, often leading to confusion and errors.

-

The Problem:Multiple users creating different versions simultaneously.Difficulty identifying the most current version.Merging changes from different contributors.

-

The Fix:Use a centralized document management system to track version history and changes.Establish consistent version numbering and check-out procedures.Implement approval workflows and logs for transparency.

2. Access Control Problems

Balancing security and accessibility is tricky, especially with remote work and departmental overlaps.

-

The Problem:Managing temporary access for contractors or collaborators.Handling transitions like role changes or employee exits.

-

The Fix:Use role-based access control and set temporary access protocols.Audit access permissions regularly to ensure security.Develop emergency access procedures for critical situations.

3. Storage Limitations

The exponential growth of digital documents can overwhelm storage systems, reducing efficiency and increasing costs.

-

The Problem:Rising storage demands and associated costs.Performance issues with large repositories.

-

The Fix:Implement tiered storage systems to prioritize high-performance needs.Automate archival processes for outdated files.Regularly clean up storage to remove unnecessary data.

4. Compliance Concerns

Adhering to varying industry and regional regulations can be complex and time-intensive.

-

The Problem:Keeping up with changing regulations.Documenting compliance procedures effectively.

-

The Fix:Develop comprehensive compliance frameworks with automated checks.Conduct regular audits and staff training to stay updated.Use automated compliance reports to monitor adherence.

5. Security Risks

Evolving threats, from unauthorized access to cyberattacks, make document security an ongoing concern.

-

The Problem:Protecting sensitive information during sharing and storage.Mitigating risks from mobile access and data breaches.

-

The Fix:Use encryption, multi-factor authentication, and intrusion detection tools.Regularly train staff on security best practices.Monitor systems for vulnerabilities and conduct regular audits.

Conclusion

Document management isn’t just a backend task or a one-time effort. But, with regular updates, you can transform it from a mundane chore into a decisive, strategic advantage.

If you’ve made it this far, you know the importance of establishing solid workflows from creation to maintenance.

To wrap it up, here are the key factors that can make all the difference:

-

Keep workflows simple and scalable.

-

Regularly audit and update your systems.

-

Ensure compliance through consistent practices.

-

Leverage automation to save time and reduce errors.

-

Train employees to follow standards and best practices.

Frequently Asked Questions

-

How long should business documents be retained?

|

Retention Period

|

Document Types

|

Examples

|

|

3–7 Years

|

Financial, Employment

|

Expense records, payroll records

|

|

7 Years

|

Financial, Legal

|

Tax records, bank statements, contracts, licenses

|

|

6 Years Post-End

|

Employment

|

Benefits documentation

|

|

Employment + 4 Years

|

Employment

|

Training records

|

|

Permanent

|

Financial, Legal

|

Audit reports, corporate records, key litigation

|

-

What security measures are essential for document storage?

Technical Measures: Use encryption, implement secure access controls, regularly monitor systems, and adopt multi-factor authentication with threat detection.

Administrative Practices: Conduct security training, establish clear access policies, and develop incident response plans to manage breaches quickly.

General Measures: Perform regular audits, maintain access logs, and update systems to address vulnerabilities and ensure compliance.

-

How often should documents be reviewed and updated?

Timelines

|

Document Type

|

Review Frequency

|

|

Critical documents (policies, procedures)

|

Annually

|

|

Strategic plans

|

Quarterly

|

|

Compliance-related documents

|

Frequently, as regulations change

|

Best Practices

-

Implement a systematic and documented review process.

-

Assign clear responsibilities to specific roles or departments.

-

Regularly update and track changes for relevance and compliance.

-

Communicate updates effectively across teams.

-

What are the legal requirements for document retention?

Consider industry, location, and document type, as retention rules vary based on these.

Policies must also comply with tax laws, employment regulations, and industry-specific mandates.

-

How can organizations ensure document consistency?

Document consistency can be ensured by:

-

Creating and maintaining style guides with standardized templates.

-

Training teams to follow document standards consistently.

-

Automating creation with pre-approved templates.

-

Conducting regular quality audits to address inconsistencies.

-

What role does automation play in document management?

Saves Time: Automates tasks like creating, storing, and finding documents, so there’s less manual work.

Reduces Errors: Keeps documents accurate and compliant with features like version tracking and approval workflows.

Makes Work Easier: Tools like smart search and system integrations help handle large amounts of documents quickly and safely.

-

How can small businesses manage documentation effectively?

Start Small: Focus on basic systems for critical documents to build strong foundations while keeping costs low.

Use Cloud Solutions: Cloud-based tools provide scalability and security without heavy infrastructure costs.

Grow Gradually: Add advanced features like automation as the business expands.

Stay Consistent: Maintain secure practices and update systems regularly to match evolving needs.

Link